Our Services

Outsourced ALM Analysis for Credit Unions

ALMPro® Classic

ALMPro Classic is our entry level service for small credit unions up to approximately $50 million in total assets. IRR and liquidity risk is estimated and analyzed by our experienced advisors and communicated back to you in the ALMPro report. We will also provide extensive training and assistance in understanding and utilizing you report. Read more about ALMPro Classic

ALMPro® Plus

ALMPro Plus provides a more robust IRR and Liquidity Risk analysis suitable for mid-sized credit unions. Small credit unions with a more complex balance sheet may also benefit from the strengthened analyses. IRR and Liquidity Risk is estimated and analyzed by our experienced advisors and communicated back to you in the ALMPro Plus report. ALMPro Plus will provide you with the risk estimates and our experienced staff will help you understand and put the analysis to productive use. Read more about ALMPro Plus

ALMPro® Premier

ALMPro Premier provides the ultimate in model power to analyze IRR and Liquidity Risk analysis. It is appropriate for credit unions of any size. Typically Premier will be used for larger credit unions at $200 million assets or greater. The Premier model uses more advance model technologies such as Instrument level analysis of loans. When combined with the knowledge and experience of our senior analysts ALMPro delivers unsurpassed modeling performance. As always ALMPro service is delivered with training and support to your request. Read more about ALMPro Premier

Ancillary Services

ALMPRO®

LIQUIDITY

INTERACTIVE

PEER ANALYSIS

THIRD PARTY IRR MANAGEMENT

PROCESS REVIEW

Budgeting Support

and Assistance Service

CECL

ANALYSIS

The new standard requires estimates of the lifetime expected credit losses at the time a loan is booked.

The new standard will not be effective until January 1, 2021 financial statements but credit unions need to start preparing their data now.

DEPOSIT

ANALYSIS

A Comprehensive Deposit Analysis from Mark H. Smith, Inc. employs an account level study to provide the highest quality analysis which includes detailed information needed to make informed decisions regarding the true nature and behavior of non-maturity deposits.

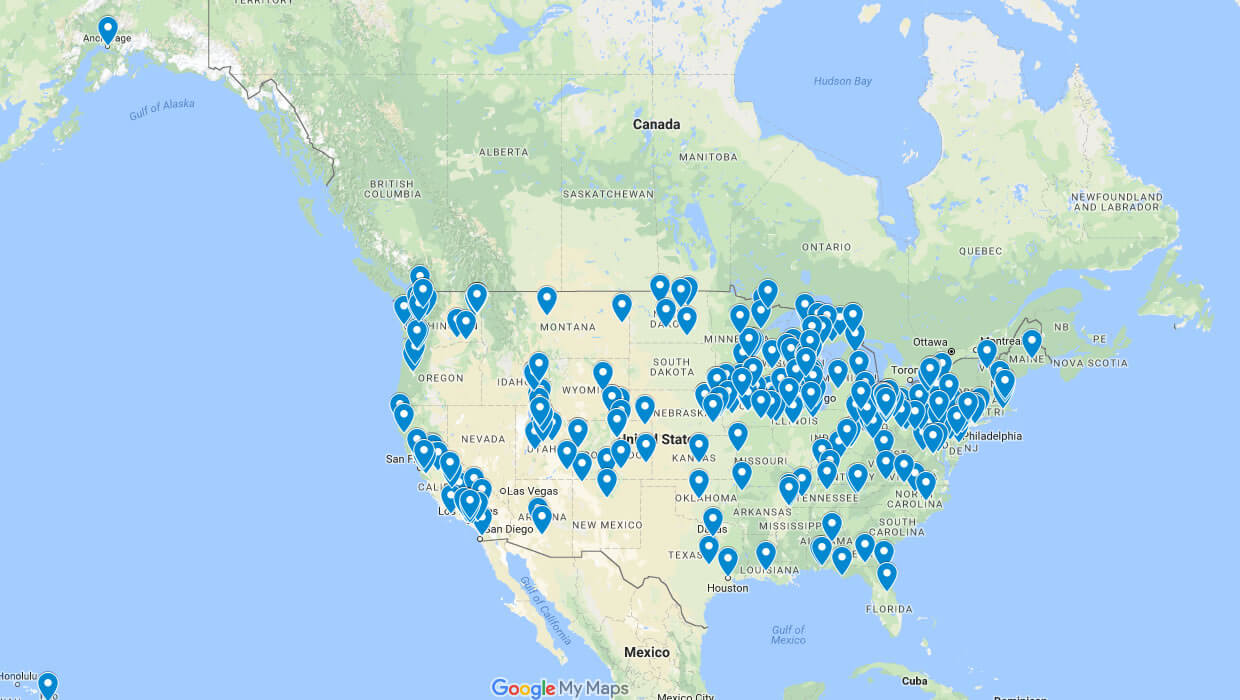

CREDIT UNIONS