CREDIT UNION ASSET & LIABILITY ANALYSIS & PLANNING

Mark H. Smith, Inc. helps credit unions of all sizes manage their balance sheet and optimize earnings with our outsourced solutions. These proven solutions include Asset and Liability Management, Interest Rate Risk Management, and Liquidity Risk Management tools. Additional areas of expertise include CECL, Interactive Peer Analysis, Comprehensive Interactive Loan and Deposit Analytics, and other supporting ALM services. MHSI strives to promote credit union success by giving personalized service, improving understanding through training, supporting the credit union’s financial stability, and assisting with regulatory compliance. Founded in 1984 with an ongoing commitment to responsive client support and competitive costs, we currently serve over 400 credit unions nationally.

Upcoming Webinars

Essential Information About Third-Party ALM Model Validations

Have you been asked to do a Third-party ALM Model Validation, or are you unsure of the benefits of completing one? Learn what it is, why this evaluation is valuable, and what areas should be included. We will also demonstrate how the validation can help the management team gain greater confidence that risk measurements are reliable, assess possible exposures accurately, and assist in making critical decisions.

View More

- Discuss how an independent third-party IRR review can be valuable

- Evaluate whether to utilize internal resources or outsourced to perform the review

- Review all elements of a good and comprehensive third-party review

- Evaluate the policy IRR management framework and key elements

- Overview of the measurement, monitoring, & assumption review

- Look at internal controls, decision-making, back-testing, and effectiveness

For additional webinars and links to past webinars, please see the resources page and click on upcoming webinars or webinar archives.

Our Services

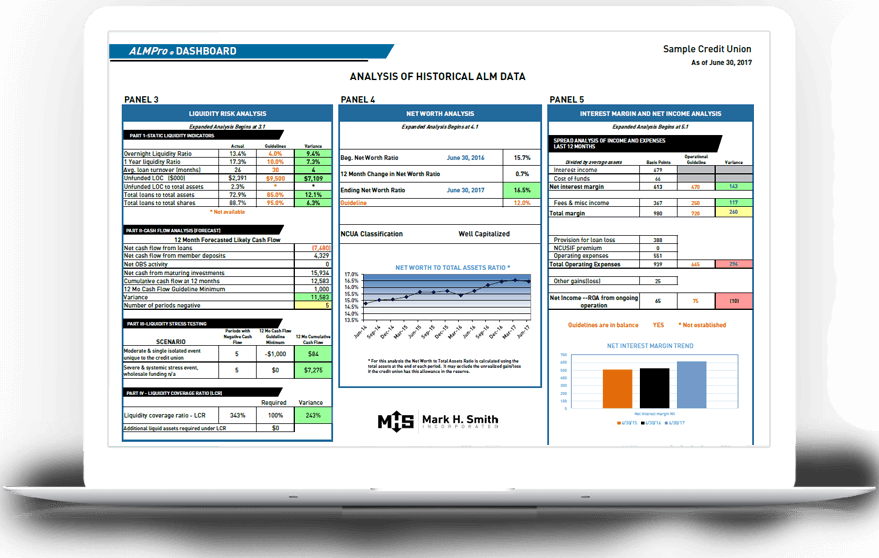

ALMPro Classic

Our ALMPro® Classic service estimates interest rate risk (IRR) and liquidity risk for credit unions with less complex balance sheets while providing a fully comprehensive ALM solution.

ALMPro Plus

Our ALMPro Plus service provides an amplified IRR and Liquidity Risk analysis and includes an Executive Summary. This level is suitable for credit unions with more complex balance sheets.

ALMPro Premier

Our ALMPro Premier service provides instrument level analytics and paramount modeling to analyze IRR and Liquidity Risk. This level is appropriate for credit unions with complex balance sheets who want more in-depth analysis or increased customization.

Interactive Peer Analysis

Our interactive peer analysis tool allows you to customize historical financial statement, performance, interest rate, and trend comparisons to your specific asset size and geographic peers.

Deposit Analysis

A comprehensive Deposit Analysis from Mark H. Smith, Inc. employs an account level study of a credit unions non-maturity deposits over time to provide institution-specific rate sensitivities, cu historical responses to market rate changes, and decay and average life of deposits.

Budgeting Support

Our Budgeting Service is available as an add-on for ALMPro clients. A senior analyst works with the CU to develop a budgeted balance sheet and the model will generate budget interest income and interest expense. The completed balance sheet and income statement budget are then completed.

ALM Model Validation

Our comprehensive IRR Model and Management Process Validation Review performs an in-depth appraisal of your IRR/ALM model as well as your entire IRR management process. The goal for us is to add value to your ALM program by leveraging our extensive experience and best-practice advice.

CECL Analysis

CECL is a new standard for Allowance for Loan and Lease Loss (ALLL) and will be effective January 1, 2021. In spite of the future effective date, credit unions need to start preparing their data now. MHSI will have a CECL solution for small to medium sized credit unions starting the 1st quarter 2018.

Still not sure which service is right for you?

At Mark H. Smith we understand this can be a very complicated process. Let us help you solve your issues, and guide you to the best solution. Our goal is to simplify and make things easier for you and your credit union, by saving time and increasing your knowledge. Let us help.

We do more for you!

How are we different?

Commitment

to Credit

Unions

Mark H. Smith, Inc. has been helping credit unions for over thirty years. Not only have we been an advocate for small to medium-sized credit unions and IRR/ALM analysis, we also take a step further and train these same leaders on how to use this information for better management decisions.

Teach & Train

as Part of our

Service

Our highly skilled staff of credit union experts put teaching and training our clients at the top of their priorities. We want you to succeed and know with the right information you can. We are happy to review your report, train your ALCO, or attend a board meeting. We also have many other ways to speed up the learning curve such as webinars and other online resources.

Expertise that is

Accommodating and

Service Oriented

In spite of being highly trained, the staff at Mark H. Smith, Inc. is here to help and be accommodating if at all possible. We want to make things easier for you and serve you with a friendly contact and a quality product with people you can rely on.