Many are calling this the most sweeping change to financial institution accounting ever!

What is it and what is changing?

CECL is a new standard for Allowance for Loan and Lease Loss (ALLL). In June 2016, FASB issued the current expected credit losses (CECL) standard – ASU 2016-13 to replace the “incurred loss” accounting model with CECL for the recognition and measurement of credit losses for loans. A similar new standard will also be implemented for investment securities.

Why is FASB Issuing the CECL requirement now?

The criticism of the current ALLL standard has been that the current incurred loss model delays recognition of credit losses and results in allowances that can be “too little, too late.” The new standard requires estimates of the lifetime expected credit losses at the time a loan is booked.

What is the timeline for credit unions?

- The new standard will be effective for January 1, 2021 financial statements.

- Many practitioners suggest a four-quarter parallel run prior to implementation.

- Early adoption is permitted beginning January 1, 2019.

What should you be doing now?

- An assessment of what data may be essential for CECL.

- Determine how much historical data is needed.

- Determine if the data is being captured and warehoused.

- Capital planning if an allowance shortfall is anticipated.

What are the data requirements?

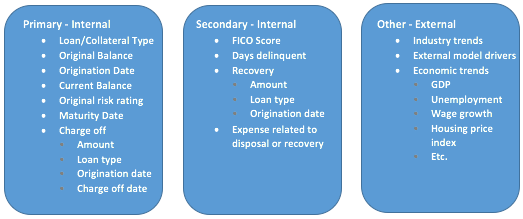

There is no set data requirements list. However, the following should be considered:

Possible model methodologies

- Historical loss rate, vintage analysis, discounted cashflow, probability of default, and other variations.

- A credit union’s current methodology may be used, but it must be modified.

Does it apply to my credit union and is it final?

All credit unions that must comply with GAAP are currently required to adhere to the new standard. The complexity of the methodology should be commensurate with the size and complexity of the credit union and still address the requirements of the new standard.

There are some organizations that are trying to get certain exceptions or simplifying modifications for smaller credit unions. Although this could happen, Mark H. Smith, Inc. does not recommend that any credit union rely on this occurrence happening in the future.

FASB is not likely to change the “spirit” of the standard at this time. However, the interpretation may continue to evolve.

At Mark H. Smith, Inc., we are seeking to find a solution to help our clients and other credit unions that can be tailored based on such things as data available, size, and complexity. Our goal is to find a solution that is cost effective, then combine it with the same high service level we always strive to achieve. We are working to have this in place by the end of 2017. Your success is our success. Thank you again for your input and support.