BY MATTHEW JACOBSEN – VICE-PRESIDENT

Are we seeing clouds gathering on the horizon for economic growth?

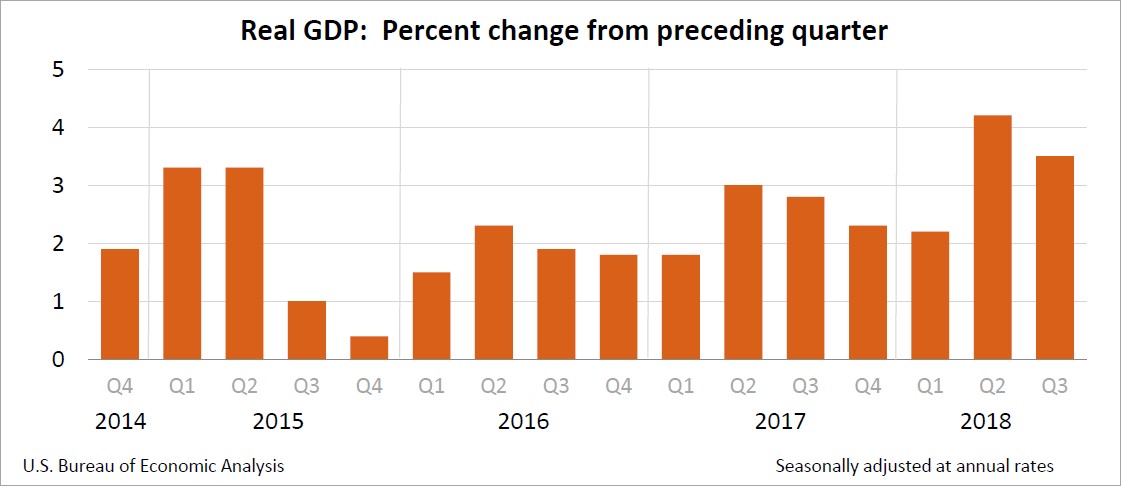

Real gross domestic product (GDP) increased at an annual rate of 3.4 percent in the third quarter of 2018 according to the “third” estimate. As seen in the chart below, the percent increase from previous quarters has picked up recently.

As a reminder, this GDP growth rate measures how fast the economy is growing by comparing one quarter to the previous quarter. The four components of GDP are personal consumption, business investment, government spending, and net trade. Personal consumption makes up the largest portion of the measurement. In addition to this solid growth rate, unemployment remains at very low levels and year over year average hourly earnings have been increasing. Looking forward, at this time, many U.S. leading economic indicators (LEIs) remain positive, but some have seen their pace of improvement slow in recent months. Nonetheless, given the above rosy scenario, how could the picture be getting cloudy?

Throughout 2018, many economists and analysts forecasted economic growth to slow (or moderate) in late 2019 or the first half of 2020. Given the above, it would seem that any economic slowdown would certainly be at least a little further down the road as many have previously been expecting. However, some analysts and economists have noted developments that could adversely impact the above growth expectations earlier in 2019 as opposed to later. In addition, there are some that believe that we could even see economic contraction in 2019.

Here is a non-comprehensive select list of issues that some are seeing as potentially adversely influencing U.S. economic growth earlier next year than previously expected.

- Economic growth in the U.S. has been stronger than many of the major developed world economies which are seeing weakening economic growth.

- Leading economic indicators in other developed countries are much weaker than the U.S. and are appearing to deteriorate further. This could have implications for the U.S. economic growth outlook if global demand worsens.

- U.S. home prices, sales, and new construction in certain areas of the country have stalled or have started to decline. The housing market has led economic slowdowns at times.

- The economic benefits of the tax cut stimulus are beginning to wane.

- The trade war may be adding to economic uncertainty and this could lead to having an economic weakening impact as trade declines during the uncertain times (remember the trade component to the GDP measure).

- The U.S. Treasury yield curve has continued to flatten going into the end of 2018 and portions of the curve have recently inverted at times. Historically, yield curve inversions have been a good predictor of recessions over the past 50 years.

Now it can certainly be easy at times to make lists of the potential negatives (and positives), but an assessment of these lists should occur in consideration of the current environment and as other economic measures unfold. Keep in mind the current U.S. and global economic expansion is coming up on a decade in duration. By historical standards, this is a very long period of growth without a recession.

Interest rate implications.

Following the Federal Reserve’s December increase in the Fed Funds target rate to a range of 2.25% to 2.50%, guidance was for at least two more in 2019 before tapering off increases in the first half of 2020. This was decreased from the September guidance where the Federal Reserve indicated three or more increases in 2019. However, market expectations at the end of December were indicating the possibility of only one 25 basis point increase in 2019 and many believe that may not even occur. Either way, both the Federal Reserve and markets are appearing to taper further increases at this time. If GDP growth continues at a solid rate in 2019, markets could be underestimating further increases. However, given the above concerns and the growing chorus of watchers that see economic weakness on the horizon, further interest rate increases could be minimal and may even be in the process of ending now. The 2018 Federal Funds rate increases were fairly predictable given the economic growth experienced. However, for 2019 the picture may not be as clear of a sky, particularly if we continue to see economic measurement clouds building. Now is the time to at least begin considering possibilities other than continual increases in short and medium term interest rates for 2019 and beyond.