By Mike Collett, Director of Marketing, Mark H. Smith, Inc.

In the fourth quarter of 2014 Mark H. Smith, Inc. conducted a survey of credit unions (both clients and non-clients) to assess their recent experiences with federal and state regulators.

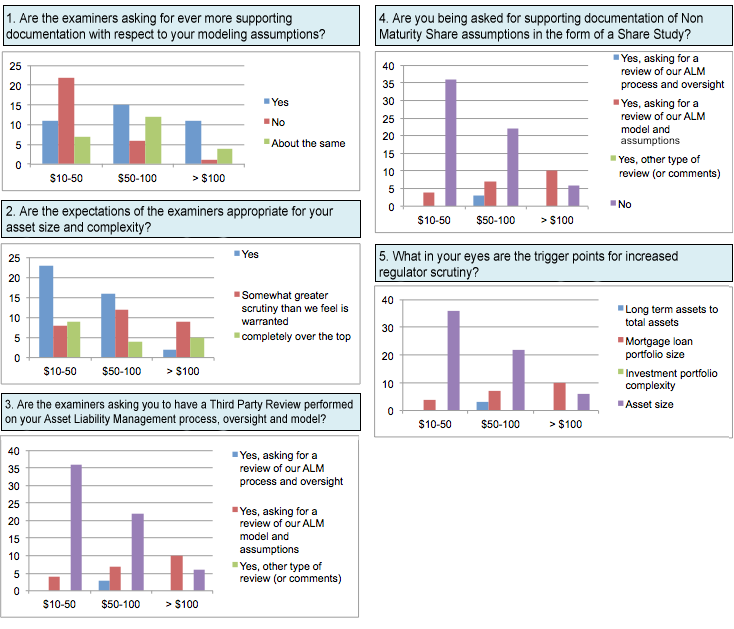

We received 89 responses from credit unions ranging in asset size from $10 million to $1 billion. As you’ll see in the data, and this was expected, the level of scrutiny is roughly proportional to overall asset size.

Here are the highlights:

$100 million – 1 billion in assets (16 responses):

- 69% of the respondents indicate that the regulators are asking for more supporting documentation for the modeling assumptions.

- 56% feel that the regulators’ scrutiny is overly dis-proportionate to their asset size.

- 63% report that their regulators are asking for a Third Party Review

- 38% report that their regulators are asking for a Share Study.

$50-100 million in assets (33 responses):

- 45% of the respondents indicate that the regulators are asking for more supporting documentation for the modeling assumptions.

- 36% feel that the regulators’ scrutiny is somewhat greater than is warranted. (12% say it’s “over the top.”)

- 30% report that their regulators are asking for a Third-Party Review.

- 27% report that they are being asked for a Share Study.

$10-50 million in assets (40 responses):

- 28% of the respondents indicate that the regulators are asking for more supporting documentation for the modeling assumptions.

- The majority (58%) feel that the examiners’ expectations are appropriate for the Credit Union asset size.

- Most all (90%) report that their regulators are not asking for a Third-Party Review.

- 90% report that they are not being asked for a Share Study.

The tabular data is shown below. It is being reported in the aggregate with no identifying credit union information other than the overall asset size categories.

(Responses on vertical axis; credit union asset categories on horizontal axis)

These are the open-ended responses to Q.5: factors the responders feel trigger greater regulator scrutiny:

- Their treatment of non-maturity deposits (multiple responses).

[The regulators tend to under-appreciate the value of the non-maturity shares.] - Change in management (multiple responses)

- Increasing Net Worth, Expansion

- Net Income

- Choice of investment options

- Risk-based capital

- Meeting minutes

- Balloon loans

- Credit risk management

- Underwriting

- Underlying assumptions

- Loan delinquency and ALL

- Liquidity

- NEV

- Level of understanding of IRR by all officers and the board

- Participation loans

- Interest rate risk

- Longer term loans and/or investments

- IRR, Security & IT

- ALM

If you have any questions regarding the survey, or the results, please contact us by giving us a call or by filling out the form to the right.